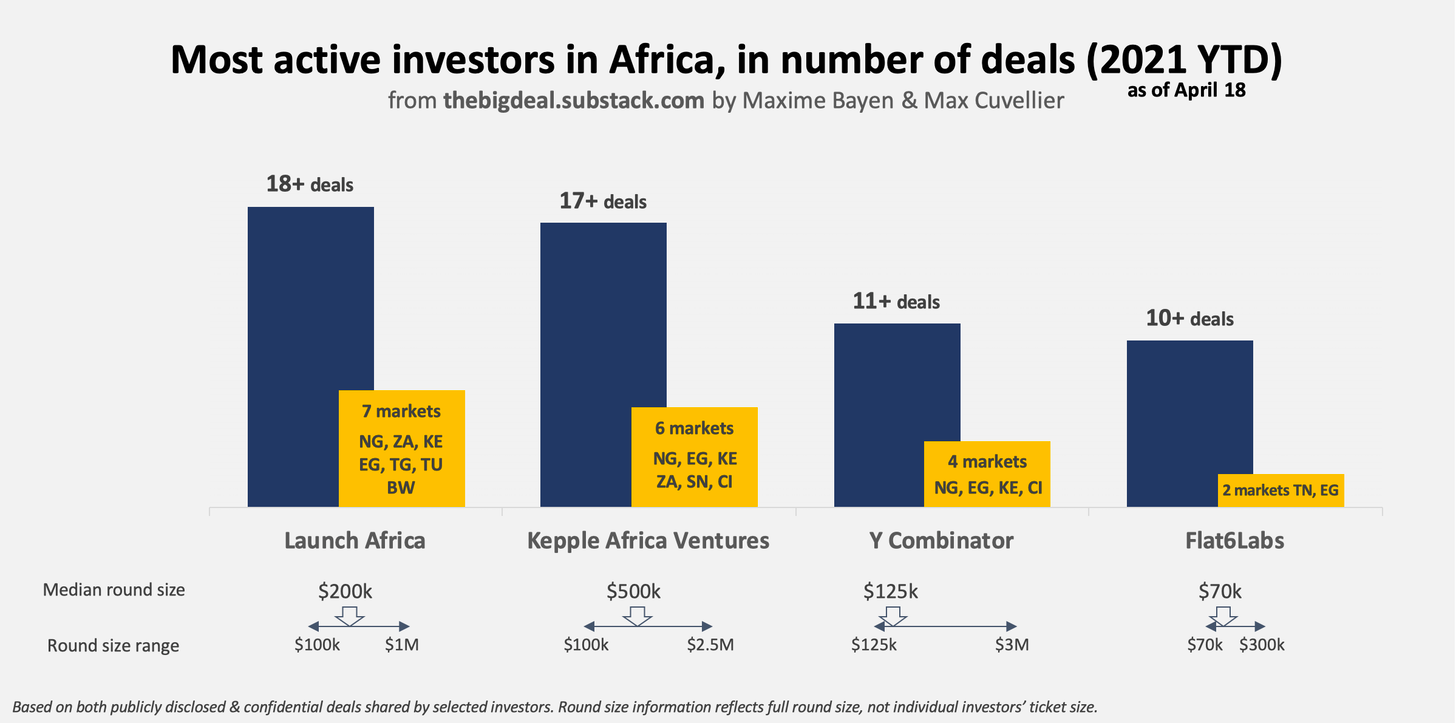

The investors rocking 2021 so far

This week we thought we’d look at the investors that have been involved in the most deals so far this year. We’re talking disclosed deals, but also some confidential ones they’ve kindly shared with us . Two players in particular – Launch Africa & Kepple Africa – seem to have taken a pretty strong lead. With 18 and 17 deals respectively, they are investing at a rate of over a deal a week(!). They are followed by Y Combinator & Flat6Labs. Beyond the volume of deals, at least two points are worth mentioning about them. Firstly, it is very encouraging to see that these most active investors are venturing outside of the “Big Four” (NG, ZA, KE, EG) and also signing deals, or taking part in rounds, with start-ups based in Tunisia, Côte d’Ivoire, Botswana, Senegal or Togo. Secondly, these Top 4 are active in rounds as low as ~$100k, and the median rounds they’re involved in are usually in that “missing middle” early-stage start-ups are often calling out ( not to misread the data: we are talking ‘overall round size’ here, not ‘individual investors’ ticket size’). Of course, many more other investors have signed deals this year already. If we include the full ‘long tail’, in 2021 so far, at least 216 investors have already participated in one deal or more on the continent. And there is no doubt some of those who were most active in 2020 (think Goodwell Investments, 500 Startups or Lateral Capital) have also been building their portfolios this year, and have a few deals up their sleeve to be disclosed soon (…or not!).

https://thebigdeal.substack.com/p/the-investors-rocking-2021-so-far

Africa: The Big Deal